A

A

A

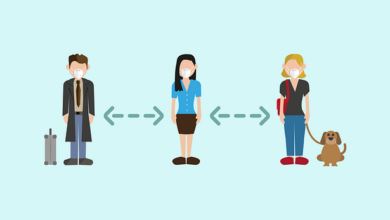

As the spread of COVID-19 has taken the world by storm, an increasing amount of businesses have been forced to shut down. The war against the virus is currently raging in the United States, where several states have issued stay at home orders while closing businesses and schools until the end of April.

The effects of COVID-19 can be felt at several levels, including family, business and unemployment. Last week saw millions of citizens apply for unemployment benefits, and that figure could grow further as the disease spreads. For all practical purposes, the global economy has ground to a halt.

Read More »

The severe slowing oof the global economic engine has sent central banks into action. The U.S. Federal Reserve, for example, has not only cut interest rates to zero again but has also initiated an unlimited quantitative easing program. Other global central banks have also taken steps to shore up their respective economies, and further steps are increasingly likely the longer the economy remains subdued.

The question many analysts, investors and everyday people are now asking is if the disease will lead to the next recession. It is looking increasingly likely that the virus will throw the global economy into recession, and some have suggested that it could be significantly worse than the previous recession of 2008-2009. President Trump had wanted the U.S. to reopen for business by Easter, but has clearly had a strong change of heart as he recently extended the stay at home order until the end of April. The longer the order is in place, the more likely a recession becomes.

For many people, a global recession will mean little or even nothing. For some, however, a global recession could have a significant impact on their lives. Whether someone may be affected may be a matter of what they do for a living and their current financial situation. A doctor or a dentist, for example, is always needed whether the economy is growing or contracting. A convert promoter or rock star, on the other hand, could find themselves unemployed or lacking work and income as the economy slows further.

A severely slowed economy can become self sustaining. As the economy slows, many people will look to save more money or avoid spending their capital. This spending avoidance not only affects the person, but it also has an impact on the economy as a whole. If someone avoids spending money on entertainment, like going to the movies, the movie theater could be forced to lay off workers or reduce its hourly schedule. As the theater reduces its operations and eliminates jobs, there are more people that may now be forced to avoid spending money. This can have an extensive effect on the economy and can spread rapidly, essentially shutting down the economic engine that keeps things going.

A recession doesn’t have to be “bad” or “extensive,” however. Sometimes a recession may last a single quarter or even less, and may simply end up being a bleep on the radar of long-term economic growth. Recessions can not only provide challenges and hardships, but may also provide potential opportunities as well. If you have been considering purchasing a company, a recessionary environment may save you quite a bit of capital. If you are looking for a long-term investment opportunity, a recession may provide a significant discount on stock prices that could pay off considerably over the long run.

Whatever the case may be, it is important to take stock of your holdings and goals any time a recession comes around. If the risk of recession seems high, that may be a good time to perform a money meeting with yourself to determine what you need to do to prepare or what objectives you may look to accomplish if the economy starts to shrink