What Is Fractional Investing in Collectibles and Why Should I Care About It?

A few years back, a certain pandemic paved the way for Wall Street bros and adult sports memorabilia collectors to learn all about a sector of securities trading called fractional investing. On the Wall Street side of things, those Wall Street Bets and Gamestop diamond-handers brought awareness to fractional stock investing apps like Robinhood and Webull, and then we saw the traditional players like Fidelity, Charles Schwab, and Vanguard get into the fractional game.

On the sports memorabilia side, it took a little while longer for similar fractional investing apps to emerge. Eventually, fractional ownership apps like Collectable, Rally, and Dibbs surfaced, which was incredibly attractive for any stimulus-check-carrying adult to grab a piece of something he or she might otherwise never own.

Read More »What Is Fractional Investing?

Let’s start with the basics, shall we? Fractional investing is an investing strategy where an investor buys a fractional share of an asset, rather than the entire thing. To give you a Robinhood-type of example, if Apple stock is trading at $500 per share and you only have $100 to invest, you could buy 1/5th (or 20%) of one share of Apple stock. Similarly, if a 1986 Fleer Michael Jordan rookie card with a PSA 10 grade is valued at, say, $750,000, and you don’t have an extra $750k lying around, you could potentially purchase fractional shares of this asset for as low as $5 or $10 per share.

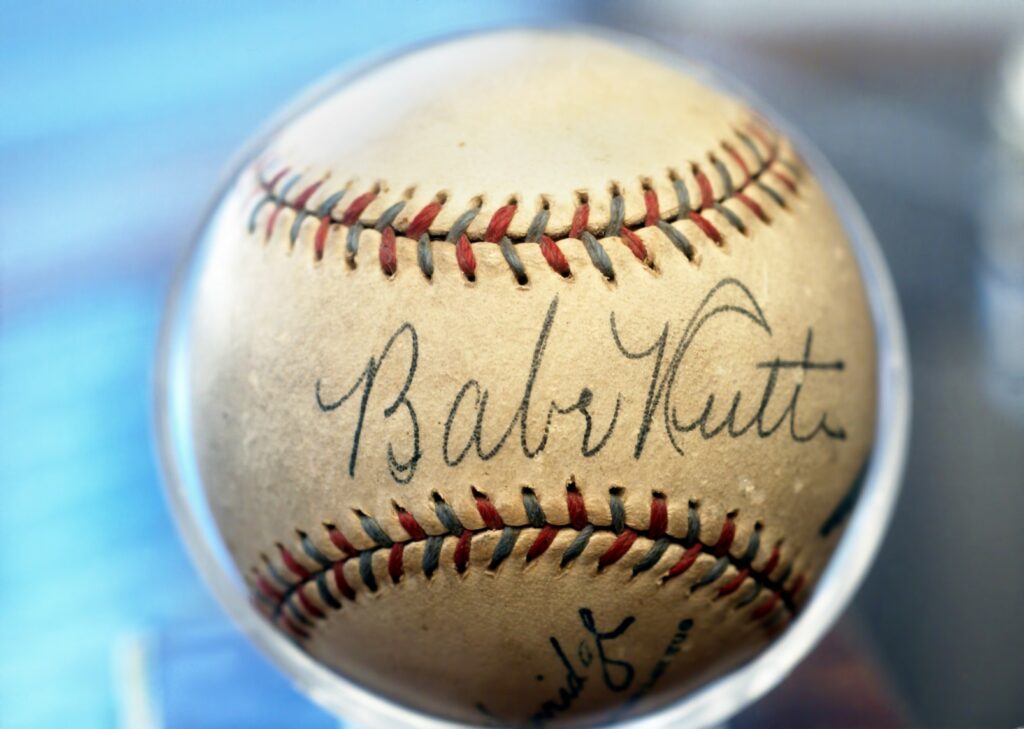

The purpose of fractional investing is to make it easier and more affordable for people to invest in assets that they otherwise might not be able to afford. And when it comes to collectibles, most people can’t afford a Michael Jordan ’86 Fleer PSA 10 rookie card or something like a football jersey that was worn in the Super Bowl and signed by the Super Bowl MVP. Something they can do, however, is turn to a sports memorabilia fractional investing app or service and see what is available. This way, investors may not own the tangible asset, but they have a stake in a piece of the asset much like a stock.

What Are the Pros and Cons of Fractional Investing?

Like with any sort of investing, fractional investing in sports memorabilia can be very attractive on paper or after listening to a podcast with a hobby expert discussing game-used equipment or jerseys. You definitely want to consider a few things before getting into sports memorabilia fractional investing, so let’s take a loot at some of the pros and cons.

The Pros of Fractional Investing in Collectibles

Fractional investing in collectibles does have some distinct advantages. For one, it’s a way for investors to get into the game without having to come up with a lot of money all at once. If an investor only has $100 to invest, he or she can easily purchase fractional shares of multiple assets rather than having to choose just one.

Another advantage is that fractional investing can help to diversify an investment portfolio. As we all know, diversification is key when it comes to investing, and fractional investing allows investors to do just that without breaking the bank.

Fractional investing in collectibles is also attractive because it can provide a hedge against inflation. As the cost of living goes up, so does the value of many collectibles. So, if an investor owns a fractional share of a valuable collectible, the value of that asset is likely to increase right along with the cost of living.

Lastly, fractional investing in collectibles can be a lot of fun. For many people, the hobby aspect of collecting is just as important as the investment aspect. Think about all of your childhood heroes that have found immortality with highly collectible items like trading cards, sports equipment and apparel, autographed items, and more. With fractional investing, investors can make financial investments and feel that certain nostalgia that makes them feel like a kid again by owning a piece of what was at one time unattainable.

The Cons of Fractional Investing in Collectibles

Fractional investing in collectibles isn’t all fun and games, however. Like with any investment, there are definitely some risks involved that investors need to be aware of before diving in head first.

The first thing to keep in mind is that collectibles are not liquid assets. This means that they cannot be easily converted into cash like stocks or bonds can. So, if an investor needs to sell his or her fractional shares in a hurry, it might not be so easy to do because they need to find a buyer. Let’s say you purchased one hundred shares of a LeBron James pair of shoes on Collectable or Rally at $10 per share. And let’s say for the sake of argument that the asset is now trading at $15 per share. If you want to sell all of your shares and pull out $1500, then you need to find a buyer for all one hundred shares. This is very different from trading stocks where the sale of a stock at a certain price near to what the stock is trading at is just about guaranteed. While you can sell your shares of those LeBron kicks on the open market, you need to set your asking price, which might be lower than the listed price per share. In order to get rid of your shares, you may need to set your price lower. That said, once your asking price is set, there is still no guarantee that you’ll find a buyer or buyers of your shares.

Much of the time, for anyone interested in investing in sports collectibles using one of these apps and turning a profit, investors are often waiting for a sports memorabilia-collecting whale to come along and offer a buyout. Using the LeBron shoes example, once the buyout offer is made and accepted by a majority vote among all of the fractional owners, then the shares are automatically cashed out—ideally at a profit per share. At that time, the asset “exits” and shares can no longer be traded.

Another thing to consider is that the value of collectibles can be very volatile. This is especially true for sports memorabilia, as the value of an item can fluctuate based on a number of factors such as the performance of a team or player, changes in popular culture, or even natural disasters. So, an investor needs to be comfortable with the idea that the value of his or her fractional shares could go up or down at any time.

It’s also important to remember that there are no guarantees when it comes to investing in collectibles (or investing in anything for that matter). Even if an asset like art, rare coins, or sports memorabilia is valuable and rare, there’s always the possibility that it could lose value.

On the sports memorabilia side of things, if a popular player tests positive for performance-enhancing drugs, or if a rookie prospect succumbs to a career-ending injury, then the investment can bottom out fast and those fractional shares could be worthless. Or if a super rare coin is suddenly made common when an estate sale uncovers thousands of a single coin, then the value of that coin and its fractional shares can tank. Investors in fractional shares need to be aware of the risks involved and be comfortable with the idea that they could lose money.

All in all, fractional investing in collectibles can be a fun and potentially profitable way to invest. However, like with any investment, there are certain risks involved that fractional investors need to be aware of before diving in. With any luck, though, those risks can be mitigated with a little bit of research and due diligence.

Is Fractional Investing in Collectibles Right For You?

If you’re thinking about investing in collectibles via a fractional investing app or by using any other similar service, then there are a few things you should consider first. Here are a few questions to ask yourself before getting started:

– Do you have the stomach for volatile investments? Collectibles can be very volatile, so if you’re not comfortable with the idea of your investment losing value, then fractional investing in collectibles might not be right for you.

– Do you have the time to do your research? Given the volatile nature of collectibles, it’s important to do your research before investing. You should understand the item you’re fractionally investing in and know the risks involved. That said, doing the research may already be built into your favorite hobby, so it may not be the chore that it sounds like.

– Are you comfortable with the idea of losing money? There are no guarantees when it comes to investing, so you should only invest what you’re comfortable with losing.

If you can answer yes to any or all of these questions, then fractional investing in collectibles might be right for you. Just remember to do your research, diversify your investments, and never invest more than you’re comfortable with losing. With a little bit of luck, you might just find yourself owning a piece of history—and making some money in the process.