From Tea Parties to Refunds: A Look at the Evolution of Tax Day

Oh, Tax Day — you notorious deadline that strikes fear in the hearts of so many Americans. It’s a day that’s dreaded by most, celebrated by few and has a history that dates back centuries.

But have you ever stopped to think about how Tax Day came to be?

Read More »You might just be surprised at what you learn!

Early American Taxes

Taxes have always been a part of history. Before the American Revolution, the British imposed a number of taxes on the American colonies. The Sugar Act of 1764 was one of the first major taxes that directly affected American colonists.

This act increased the tax on sugar, molasses, and other commodities that were imported into the colonies. The Stamp Act of 1765 was another major tax that required the purchase of a stamp for printed materials, such as newspapers and legal documents.

These taxes were met with serious resistance from the colonists who believed that they were being unfairly taxed without any real representation in British Parliament.

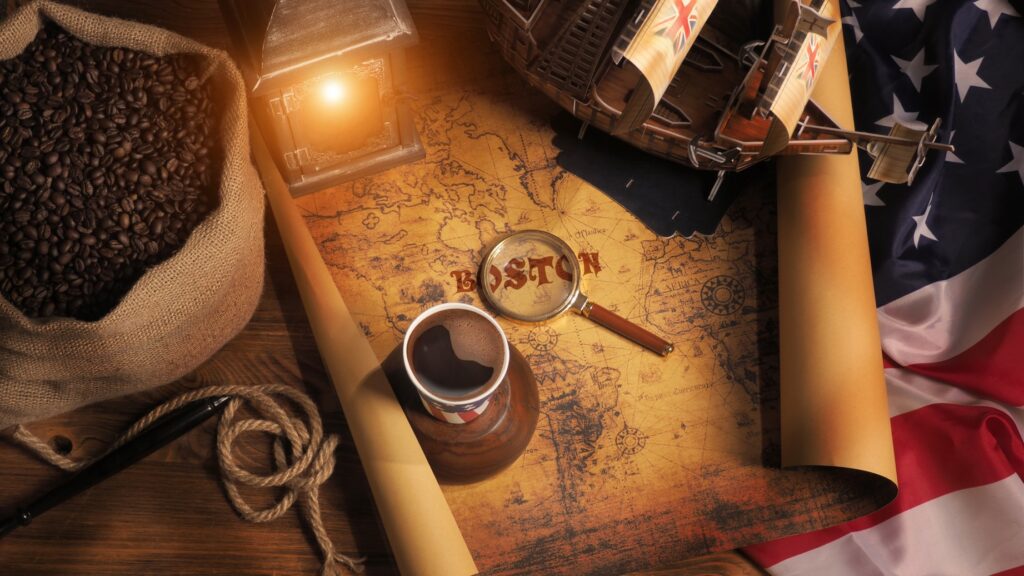

This led to protests and demonstrations throughout the colonies, including the infamous Boston Tea Party in 1773. During this iconic historical event, a group of colonists disguised themselves as Native Americans and boarded British ships in Boston Harbor.

They then proceeded to throw hundreds of chests of tea into the water as a protest against the Tea Act, which had granted the British East India Company a monopoly on tea sales in the colonies.

The British responded to this act of rebellion by imposing a series of punitive measures on the colonies, including the Coercive Acts, which were also known as the Intolerable Acts. These acts closed Boston Harbor and restricted the political rights of the colonists.

This further fueled the flames of revolution, and the colonists began to organize themselves to fight for their independence from British rule.

The resistance to British taxes and the subsequent revolution had a profound impact on the history of taxation in the United States.

It established the idea that taxation should only occur with the consent of the governed and led to the creation of a new government that was based on the principles of liberty and representative democracy.

Early United States Taxation

After gaining independence from England, the United States established a new government and began to develop its own system of taxation. One of the first significant taxes imposed by the U.S. government was the Whiskey Tax in 1791.

This tax was enacted by the newly formed federal government in order to raise revenue to pay off the national debt that had been incurred during the Revolutionary War.

The Whiskey Tax was super controversial and led to protests and even violence, particularly in western regions where whiskey was a major product. The tax was eventually repealed eleven years later in 1802.

In 1861, the U.S. government passed the first income tax law in order to finance the Civil War. The law imposed a 3% tax on incomes above $800 per year — and was considered a major fleecing back then by the day’s standards (some things never change).

The income tax was incredibly divisive and led to a number of legal challenges. In 1895, the Supreme Court declared the income tax to be unconstitutional, but in 1913, the 16th Amendment was ratified, and that gave Congress the power to impose an income tax, solidifying it as a necessary evil.

These early taxes and the controversies surrounding them established the precedent that taxation should be tied to the needs of the government, and that taxes should be imposed fairly and with the consent of the governed.

They also highlighted the importance of balancing the needs of the government with the rights and freedoms of the citizens.

Enter the IRS

The Internal Revenue Service (a.k.a. the IRS) is the federal agency responsible for enforcing and collecting taxes in the United States. The IRS was created in 1862 during the Civil War in order to raise revenue to fund the war effort.

The agency was initially responsible for collecting taxes on income, but its responsibilities have since expanded to include enforcing tax laws, investigating tax fraud, and administering tax-related programs and services.

The first Tax Day, or the deadline for filing income tax returns, wasn’t until March 1, 1914. This date would be later changed to March 15, and then again to April 15, where it currently remains.

The evolution of Tax Day has been influenced by a number of factors, including changes in tax laws, advances in technology, and the needs of the government.

Over time, Tax Day has become an important part of American culture and often elicits stress and anxiety for most taxpayers. The IRS has made efforts to simplify the tax filing process and to provide resources to help taxpayers navigate the system.

These efforts have included the creation of electronic filing options, the expansion of free tax preparation services for low-income taxpayers, and the development of educational resources to help taxpayers understand their rights and obligations.

Despite these efforts, the IRS and Tax Day continue to stoke controversy in American politics. Some argue that the tax system is too complex and burdensome, while others believe that taxes are necessary to support government programs and services.

The debate over taxes and the role of the IRS is likely to continue for many years to come, as Americans grapple with the challenges of balancing the needs of the government with the rights and freedoms of individual citizens.

The Modern-Day Tax System

The modern-day U.S. tax system is a complex and multifaceted system that includes a variety of taxes at the federal, state, and local levels. The federal government collects taxes on income, property, and goods and services, while state and local governments collect taxes on property, sales, and other forms of revenue.

The biggest or most significant tax that Americans pay is the federal income tax. The federal income tax is a progressive tax, which means that the amount of tax paid increases as income increases. In addition to this, Americans may also be required to pay state income taxes, which vary depending on the state in which they reside.

Another important tax that Americans pay is the payroll tax, which is used to fund Social Security and Medicare. The payroll tax is a flat tax that is based on a percentage of an individual’s income, up to a certain limit. The tax is split between the employee and the employer, with each party paying a portion of the tax.

Americans also pay a variety of other taxes, including property taxes, sales taxes, and excise taxes. Property taxes are assessed on the value of real estate and are used to fund local government services such as schools and roads.

Sales taxes are assessed on the purchase of goods and services and are used to fund state and local government services. Excise taxes are assessed on specific goods and services, such as tobacco and alcohol, and are used to fund government programs and services.

One of the most notable aspects of the modern-day tax system is the refund system. Taxpayers who overpay their taxes are eligible to receive a refund of the excess amount paid.

Refunds are typically issued after the taxpayer files their tax return, and the amount of the refund is determined by the amount of taxes paid and any deductions or credits that the taxpayer is eligible for.

We love the refund system. It’s an important part of the tax system, as it provides a way for taxpayers to recover excess taxes paid and can serve as a source of financial relief for many Americans.

However, it’s also unfortunately subject to fraud and abuse, and the IRS has implemented a number of measures to prevent fraudulent refund claims and protect taxpayers’ personal and financial information.

The Bottom Line

Tax Day is a drag, sure, but it’s an essential part of the country’s economy. Income taxes are a necessary part of financing government operations and supporting public services such as education, infrastructure, and national defense.

These taxes help to ensure that everyone contributes to the funding of government programs and services and that the burden of paying for these programs and services is shared fairly across the population.

Without income taxes, the government would be unable to provide essential services and would have to rely on other sources of revenue, such as borrowing or printing money, which can have negative consequences for the economy and for individuals’ financial well-being.

Be Prepared for Tax Day

When it comes to tax day, it pays to be prepared. Knowing what taxes you owe and how they’re calculated is essential for avoiding costly mistakes or filing penalties. It’s also important to familiarize yourself with the various deductions and credits available to you, as these can help to reduce your tax bill.

Reviewing your return before filing will also help to ensure that all information is accurate and complete and can help you to avoid any costly mistakes. So be sure to stay organized with your tax documents throughout the year to make it easier for you to file your taxes quickly and accurately on Tax Day.

Taxes may not be fun, but by understanding how they work and taking the time to file correctly, you can make the most of Tax Day and maximize your tax savings!